-

A) National/Regional Aspects

Switzerland has many expats who come and go after some time. This reflects in their financial and pension system.

Due to the decentralized set up of the country, you will always have to pay attention to national and regional (canton) aspects regarding law and tax.

-

B) Swiss Pension Overview

-

C) Pillar 1: Governmental Pensions

State Old Age Pension/AHV

Premium

Both employees and employers are required to pay premiums. Employee contributions are deducted directly from your wages. To receive the full pension, they have to have contributed in full. This means you and your employer have made payments without interruption from the time you were age 20 until retirement age.

Flexible Pension Age

Women receive an AHV pension from the standard age of 64 and men from the age of 65.

You can draw your pension one or two years before the standard retirement age. If so, it will of course be lower. An estimated 6,5% per year.

You can also defer drawing your AHV pension by a minimum of one and a maximum of five years. This will increase the amount of pension you will receive each month.

Height of Pension

The level of your AHV pension depends on several factors:

• the number of years you have contributed;

• the level of your income;

• any contribution credits you have received for bringing up children or caring for other persons.The level of the pension you receive then depends on your average annual income. The minimum and maximum levels are:

• You will receive a pension of CHF 1,175 per month if you have paid contributions without interruption and your average annual income did not exceed CHF 14,100;

• You will receive a pension of CHF 2,350 per month if you have paid contributions without interruption and your average annual income was at least CHF 84,600.Regarding marrried couples each spouse’s income is added together and the total is divided by two to obtain the amount credited to each spouse. This division of income is made:

• if both spouses are entitled to State pensions;

• if a widow or widower is entitled to an old-age pension;

• if the marriage is ended by divorce.The sum of the two individual pensions may not exceed 150% of the maximum single pension (i.e. CHF 3,525). If this maximum is exceeded, then the two individual pensions are reduced accordingly. Finally the AHV site has a tool to calculate your estimated pension. You can also request a calculation of your future pension.

Payment Abroad

If you are a Swiss national or from an EU or EFTA member state, you have in general the right to receive your AHV pension abroad.

Before leaving Switzerland, you must announce your departure to your compensation office which will then forward your application to the Swiss Compensation Fund in Geneva. Recipients of AHV benefits freely choose their payment address (in Switzerland or abroad). AHV benefits are generally paid to recipients residing abroad in the national currency of their country of residence.

Since the entry into force of the bilateral agreements, Swiss pre-retirees domiciled in the EU are no longer able to make voluntary contributions to the AHV and therefore only receive a partial AHV pension. A gap in contributions of a year generally leads to a 2.3% decrease of the pension.

State Next Of Kin Pension

Basic Coverage

To prevent financial hardship after the death of a spouse or a parent, the survivors (spouse, registered same-sex partner, children) can receive a surviving dependants’ pension. A distinction is made between a widow’s, a widower’s and an orphan’s pension.

Amount/Caldulation

Survivors are entitled to a surviving dependants’ pension provided the deceased paid AHV contributions for at least one year. If there are no gaps in the deceased’s contributions, the minimum and maximum pensions are as follows:

Minimum amount CHF/month

Maximum amount

CHF/monthWidow’s/widower’s pension

940.-

1880.-

Orphan’s pension

470.-

940.-

Survivors who already receive a retirement or invalidity pension, receive an additional 20% on top of their retirement or invalidity pension instead of a separate survivor dependant's pension.

To find out the exact amount of your surviving dependants’ pension, you can contact the office of the deceased’s AHV pension fund.

-

D) Pillar 2: Workplace Pensions

The occupational pension scheme is known as the ‘Berufliche Vorsorge’.

Compulsory For Employee

It is a funded pension plan. It is compulsory for employees and is financed by both employees and employers. The sum of the contributions of the employer should be at least equal to the sum of the contributions of his employees.

Voluntary For Self-Employed

It is also opened to the self-employed on a voluntary basis. The contributions differ according to the regulations of the institutions providing it.

Institutions

Pension funds are organised as foundations which invest their capital. They can be created by:

• Authorities;

• Private corporations for their own personnel;

• Insurance companies;

• Trade unions/professional associations/unions of employers for their members.Life Insurers

Life insurers manage around one fifth of the total second-pillar assets and insure some 1.8 million employees, primarily at small and medium sized enterprises in Switzerland. Approximately one quarter of pensioners in Switzerland receive occupational pension annuities from one of the eight life insurers operating in the group life business.

Life insurers cover the risks of old age, disability and death in the second pillar. They do this for both individual and group pension schemes that are not large enough to bear all or parts of their insured risks themselves. Pension schemes conclude group life insurance contracts with private life insurers for this purpose.

Occupational pensions are provided by pension schemes – legally independent personal or group pension schemes – that are subject to the Swiss Federal Act on Occupational Old Age, Survivors’ and Disability Pensions (Occupational Pensions Act, OPA). These pension schemes are supervised by cantonal authorities, which are in turn accountable to a national oversight commission (OAK).

Private life insurers that reinsure some or all risks and take on some or all capital management for personal and group pension schemes, are subject to the Insurance Supervision Act (ISA).

Benefits

The second pillar offers old age pensions. Some of the pension funds also provide benefits in case of disability and to the next of kin in case of premature death.

Flexibility

The funds in the second pillar can be used before retirement to buy a principal home, to start an independent activity, or when leaving Switzerland permanently.

Between Jobs

When changing employment, funds are transferred to the pension fund of the new employer. When unemployed, the funds are transferred into a savings account called ‘Freizügigkeitskonto’ or ‘Compte de libre-passage’. When the person resumes working, the savings can be transferred into the pension fund of the new employer.

-

E) Lost Occupational Pensions

It still happens too often that Expats due to their many relocations lose oversight of their pensions.

If you might have acquired a Swiss Occupational Pension Claim but have lost track of it, feel free to go to the following site and request assistence of the Swiss 2nd Pillar Central Office:

-

F) Pillar 3: Private Pensions

These private pension schemes are provided by the private sector.

Type of Plans

They are optional and financed entirely by the insured person. There are two versions:

• 3A Plans result in less taxation and are regulated;

• 3B Plans do not have tax benefits and are unregulated.3A Plans

There are in essence two different kind of plans:

• Insurance plans which often combine capital build up with risk coverage;

• Savings/Investment accounts which in general only focus on capital build up.

The annual amount that can be deposited with tax benefits is limited. It is allowed to invest in several 3A schemes at the same time but the total annual tax benefit remains equal.As these schemes result in reduced income and property taxes, the funds can, similar to those of pillar 2, only be paid out in very limited circumstances.

As these funds can only be dissolved at once and not as an annuity, it seems advisable to if so desired open several schemes whose funds can be used independently. Funds in these schemes can’t be split but only transferred as a whole to another 3A scheme.

If the insured man or woman continues working beyond the retirement age, he/she can invest into the 3rd Pillar up to the age of 70 or 69. After which age, the funds will be paid out compulsorily.

3B Plans

These kind of schemes do not exist officially. But in banking/investment jargon any investments which are intended to fund retirement are called 3B Plans. They do not offer any taxation benefits and are not regulated in the manner 3A Plans are.

-

G) Leaving Switzerland/ Early Pension Pay-Out

As many Expats live for several years in Switzerland and then relocate to their new country of residence, there is often the question what their options are regarding their acquired Swiss pension claims.

Pillar 1: Governmental Pensions

Anyone who has worked in Switzerland and then leaves the country is entitled to, depending on their nationality, receive either a refund of the paid OASI premium or an OASI pension.*

If Switzerland has a Social Insurance Agreement with the returnee’s home country, the OASI pension will be paid abroad. Some Social Insurance Agreements also provide for a refund of contributions. If there is no such agreement, on request the OASI contributions may be refunded without interest.

Finally like most other countries, the already build up or acquired pension claims can not be transferred to similar pension claims in the next country of residence.

* Old age and survivors' insurance (OASI) is the most important first pillar of old age and survivors' benefits in Switzerland. It covers subsistence needs in old age or the event of a death. As a form of national insurance, OASI is obligatory for everyone.

Pillar 2: Occupational Pensions

Anyone leaving Switzerland to settle in an EU/EFTA Member State, may generally not cash in their pension from the compulsory pension plan as persons in the new country of domicile are insured by law to receive old age, survivors' and invalidity benefits.

The mandatory portion of the pension assets must therefore remain in a blocked account in Switzerland and can only be paid out when you reach retirement age.

The extra mandatory portion of your pension, however, may be paid out in cash. The mandatory and extra-mandatory portions of your pension are listed on the personal insurance certificate under the heading ‘Retirement provision information’.

Pillar 3: Private Pensions

Many Swiss taxpayers have a Pillar 3A Private Pension Plan which they bought at a bank or insurance company.

These plans are not coordinated under the Swiss/EU or any other Social Security Agreements. Thus they are treated in a rather direct way: If an Expat decides to leave Switzerland and permanently live in another country and no matter where, these kind of plans can be cashed.

When this exactly should happen is a question of good timing. Many countries tax a Lump Sum payment from a Swiss Private Pension Fund. It is therefore often advisable to cash the Pillar 3A plan shortly before departure and have it taxed at the very favorable Swiss tax rates on capital payments.

In certain circumstances it may even be an option to keep the Pillar 3A plan in order to benefit from the insurance and Swiss Franc Savings in Switzerland. This is mainly possibly if you have a Pillar 3 as an insurance policy rather than as a bank fund.

-

H) Tax

As expats will often have several State/Workplace/Private Pension claims in different countries and might retire in another country, it is relevant to pay attention to DTA Tax Treaties between countries.

They try to prevent or limit the possibility of double taxation in two countries being the residence and source country. Except for the Africa region, Switzerland has many active DTA’s.

Due to the complexity of pensions and taxation combined, it is our standard approach to request official statements from each national tax authority involved.

-

I) Pension Oversight

Finma: Risk-Oriented Approach

FINMA is Switzerland’s financial-markets regulator. The institutional, functional and financial independence FINMA enjoys, enables it to exercise effective supervision over Switzerland’s financial industry.

Finma supervise banks, insurance companies, exchanges, securities dealers, collective investment schemes, and their asset managers and fund management companies. It also regulates distributors and insurance intermediaries.

FINMA is mandated to protect financial market clients – creditors, investors and policyholders – and is responsible for ensuring that Switzerland’s financial markets function effectively.

Its supervisory tasks -authorisation,supervision and, where necessary, the enforcement of supervisory law– are derived from that mandate. In addition, FINMA can also regulate activities where it is authorised to do so.

In performing its supervisory activities, FINMA adopts a systematic risk-oriented approach and is mindful to ensure continuity and accountability. This strengthens confidence in the proper functioning, integrity and competitiveness of Switzerland's financial centre.

Website

-

J) News April 2024

Implication New Double Tax Treaty The Netherlands & Switzerland

As of 2021 there is a new double tax treaty. One of the most relevant changes regarding pensions and private annuity is the following: Pensions and private annuity pay-out will be taxed by the country from which they originate.

This change of the treaty was meant to simplify the rules of applicable taxation but especially for persons living in Switzerland it is relevant to check the exact implications for them. Especially if they also have other sources of income.

Switzerland Adjusts Mandatory Second Pillar Pensions To Inflation From 2022

Part of the pensions mandatory pensions under the second pillar will see for the first time an adjustment in line with inflation from next January 2022, the Swiss Federal Insurance Office (FSIO) said in a note.

An adjustment of 0.3% will apply from 1 January 2022, to disability and survivors’ pensions paid out since 2018, and of 0.1% for pensions paid out for the first time in 2012.

The rate of 0.3% for pensions running from 2018 results from the development of prices between September 2018 and September 2021, based on the consumer price index (CPI).

Survivors’ and disability mandatory pensions in the second pillar are periodically adjusted until retirement age to mirror the increase in the consumer price index.

According to the Swiss Federal Statistical Office (FSO), the CPI remained stable in September compared with the previous month, at 101.3 points. Inflation stood at 0.9% in September compared with the same month the prior year.

CPI’s stability is the consequence of “opposing trends” balancing each other, said the FSO, pointing at the prices for heating oil and air transport that increased while the prices for international package holidays decreased.

Moreover, certain survivors’ and disability pensions that have never been adjusted to inflation, and paid since 2008, 2011 and 2012, could go through realignment with the trajectory of prices on 1 January 2022.

A comparison of the CPI for September 2021 with the index for 2008, 2011 and 2012 shows so far that only the survivors’ and disability pensions paid out since 2012 have to be adjusted to price developments for the first time in January next year.

The adjustment rate for the survivors’ and disability pensions paid out since 2012 is 0.1%, based on the change in prices between September 2012 and September 2021, according to the CPI.

The pension insured under the first pillar AHV pensions won’t see an overall adjustment to inflation in 2022. An adjustment of survivors’ and disability pensions through the CPI will be examined as part of the next increase of AHV pensions in January 2023 at the earliest, the FSIO said.

Pension funds can instead decide to adjust pensions in line with inflation, taking into account their financial resources and for benefits that do not have to go through a periodical adjustment prescribed by law.

Swiss Pensions: No Big Reform But Patch Up Adjustment

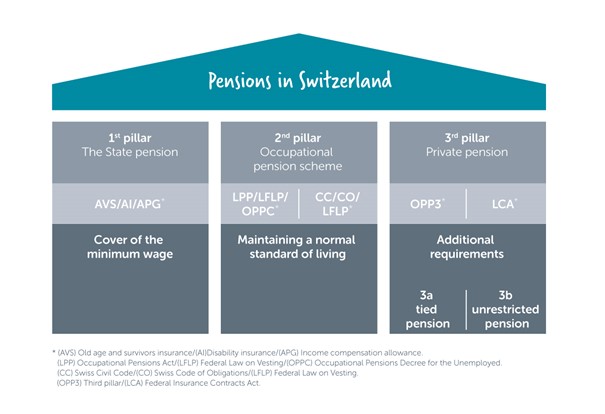

The Swiss pension system is based on three Pillars:

- Old-age and survivors’ insurance;

- Occupational pension planning;

- Private saving for old age with tax breaks.

This set-up enables risk-sharing. The system gives Switzerland a time advantage over other countries; but it will not save it from the consequences of an aging population which, according to forecasts, will be unable to finance the pensions of future retirees if corrective measures are not taken.

“The bomb has been triggered”, states Professor Gächter bluntly. Although the Swiss government keeps warning that time is running out, reforming the pension system is a huge work in progress that has been under way for decades, and will certainly not be completed any time soon.

The federal government has now given up (!) on the idea of “far-reaching surgery” and instead chosen the path of “patching up here and there”. A strategy that has emerged as all its proposals for major overhaul have either run aground in parliament or been rejected by the people.

A forecast for other countries that need to reform?

Are Swiss Pensions Too High?

System Under Pressure

The Swiss pension system is in danger of collapse. At the same time, Swiss retirees get higher pensions than almost anywhere else in the world. Is the country due for a reality check?

The Swiss are a nation of happy pensioners. A study by UBS found that in Switzerland generous pensions mean that people must save the least for their old age – and that is in a country that hast the highest cost of living in the world.

Anyone in Switzerland who has been a full-time employee for their whole working life can look forward to a comfortable retirement.

3 Pillars

Switzerland has a pension system which is based on three pillars:

1] The state old-age pension provides a basic minimum pension for all.

2] Workers also have to belong to a employer-sponsored pension fund, which is designed to maintain their existing standard of living beyond retirement.

3] Voluntary saving by individuals, which is encouraged by tax breaks.

Spreading the risk

Switzerland has always been a model for other countries with its three strands of old-age security. The model is great, but it has never been completed.

Government invests too little in the first strand so that the basic old-age pension no longer enables anyone in Switzerland to get by. The second strand, private pension funds, is being hampered all the time by low interest rates: if the invested capital brings little in the way of returns, the promised pensions cannot be paid for. There are funding gaps.

Demographic developments are making the problem bigger, especially as regards the government’s basic pension. A large generation of baby-boomers is now reaching pensionable age. A majority of Swiss now take early retirement, and life expectancy is among the highest in the world. So the time-bomb is ticking away.

It’s ticking not just in Switzerland, of course, but in many industrial countries.

Other countries will be hit first. Thanks to the three independently-funded strands, Switzerland has spread the risk, which is an advantage. But even in Switzerland there will be problems eventually.

Pensions are too high? Generation Conflict!

The first dark clouds have in fact begun to appear over Switzerland as the “pensioner’s paradise”. Some of the private pension funds have lowered their conversion rate, which means reduced pensions for future generations.

Such corrective measures are needed, for the pension funds in recent years have being paying out at an unsustainable rate – and current pensions cannot be changed. Over several years, the conversion rates used were too high.

One generation – the most recent groups who have been retiring – will be getting more for the rest of their lives than they ever paid in. Generation X will be the loser generation. They have paid in plenty, but they won’t get as much back. They have helped to fund the pensions of the older generation.

Calls for variable pensions

In the private pension funds, there is still an involuntary redistribution going on involving millions of francs from the working population and the employers to current pensioners.

On average this amounts to over CHF7 billion annually, or about 25% of pensions. In this contributory pension system, unlike the government’s old-age pension, there should actually be no redistribution.

Since April, a committee has been gathering signatures for a people’s initiative called "Old age security – keep it fair. For reform that does justice to all generations". It was launched by pensioner Josef Bachmann. He used to be CEO of a private pension fund.

The initiative calls for variable pension fund payouts depending on return on investment, so that there need be no redistribution from workers to the pension-age generation. What this means is: if things go well on the stock exchange, you get a higher pension – if things go badly, you get a reduced amount.

Also entering into the calculation would be demographics and the cost of living.

Already retired people could see their pensions reduced – and for Switzerland, that would be completely new. The basic idea of variable pensions is the acceptance that pensions cannot be fixed in advance. Having fixed pensions always leads to redistribution, with younger generations picking up the tab. This injustice has got to a stage where it’s crying out for something to be done.

Swiss Regulator: More Pension Funds To Be Underfunded After 2018 Volatility

The funding level of some Swiss pension funds is set to fall considerably after the equity market volatility of last year.

Preliminary calculations relating to funds from the cantons of Zurich and Schaffhausen were presented by the BVS, the regional supervisory body for Pensionskassen and foundations in these two cantons.

Speaking at the authority’s annual conference, Roger Tischhauser, director of the BVS, said that “a typical pension fund will report a lower funding level by 400 to 600 basis points because of the capital market developments” in 2018.

This year, Tischhauser said he expected “an additional 12 or more pension funds” under BVS’ supervision to report underfunding in their 2018 annual reports.

For 2017, the group of more than 750 pension funds supervised by the BVS showed a significant improvement in its funding position. Compared to 2016, the number of underfunded schemes fell from 10 to four. The funds with shortfalls in 2017 were smaller schemes with combined assets of CHF4bn (€3.3bn).

Equity market volatility hit Swiss pension funds last year, a development also reflected in the industry indices compiled by UBS and Credit Suisse, as well as preliminary results published by Publica, Switzerland’s largest pension fund.

Nevertheless, Tischhauser said he was impressed by how the average pension fund had developed over the past few years.

In 2017, over 80% of all funds supervised by the BVS were 100% funded and around 50% had “already restocked the necessary funding buffers”, which had been emptied in the wake of the financial crisis, Tischhauser said.

He highlighted public pension funds, which “can look back at seven years of very hard work” since they were legally transformed into entities independent of the canton’s authority.

In total, the BVS oversees almost CHF300bn in occupational pension assets, more than one third of the total CHF850bn in the Swiss second pillar.

Collective pension funds as systemic risk factors

Tischhauser also defended proposals from Switzerland’s top finance regulator, the OAK, regarding new rules for collective pension funds, the Sammelstiftungen and Gemeinschaftseinrichtungen.

He contradicted critics who recently spoke out against further regulation for this sector within the second pillar. The OAK wants to introduce additional risk reporting requirements for such plans.

Tischhauser said a “consistent set of rules” was necessary for this sector.“In this segment, which is of systemic importance, financial stability has to be increased and for this we need a unified regulatory framework,” he said. He explained that, given the competition in this sector, collective pension funds on average “took more risks in their investments and made higher promises” than company pension funds not open to outside customers.